vermont department of taxes homestead declaration

The Vermont Homestead Declaration By Vermont law property owners whose homes meet the definition of a Vermont homestead must file a Homestead Declaration annually by the April. Due to the current health situation the due date has been.

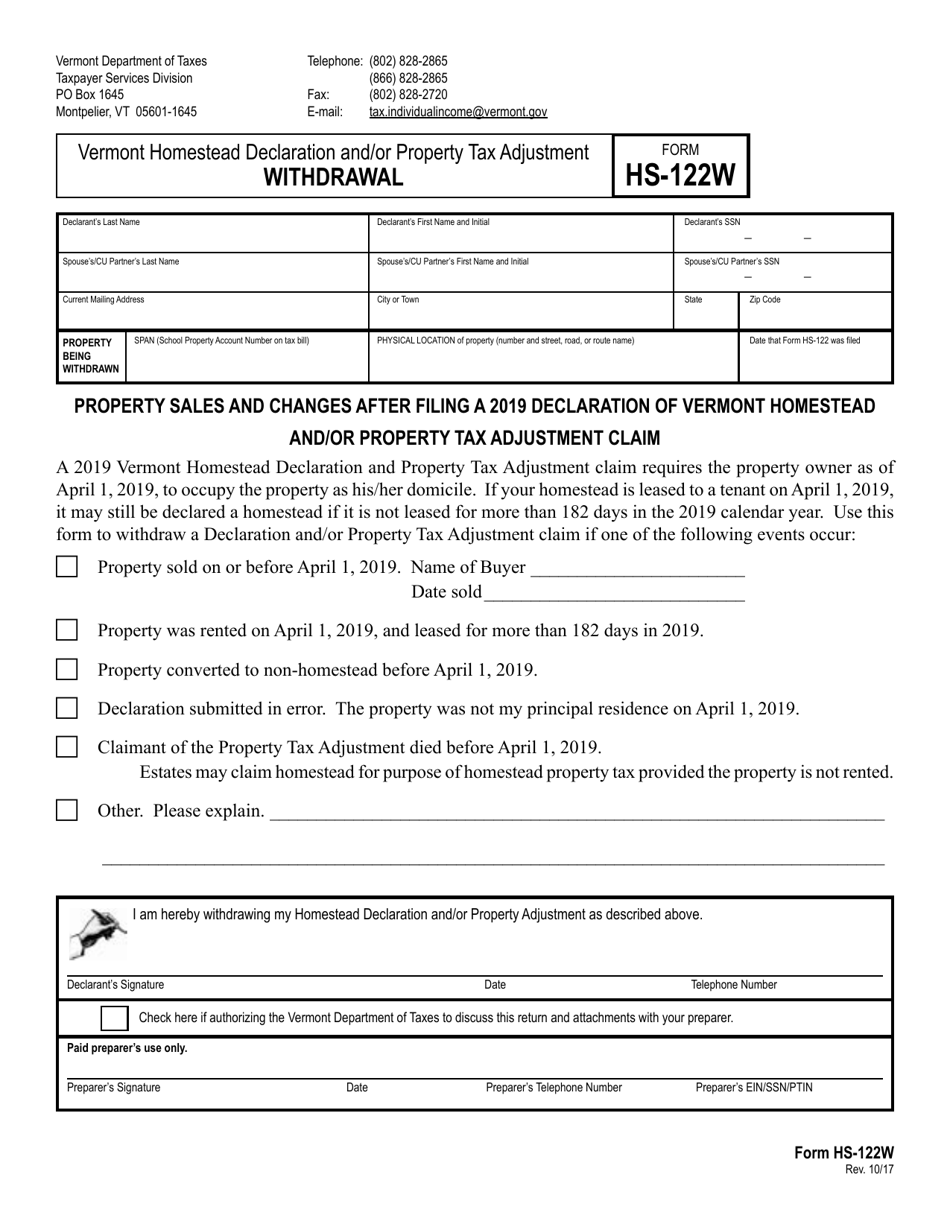

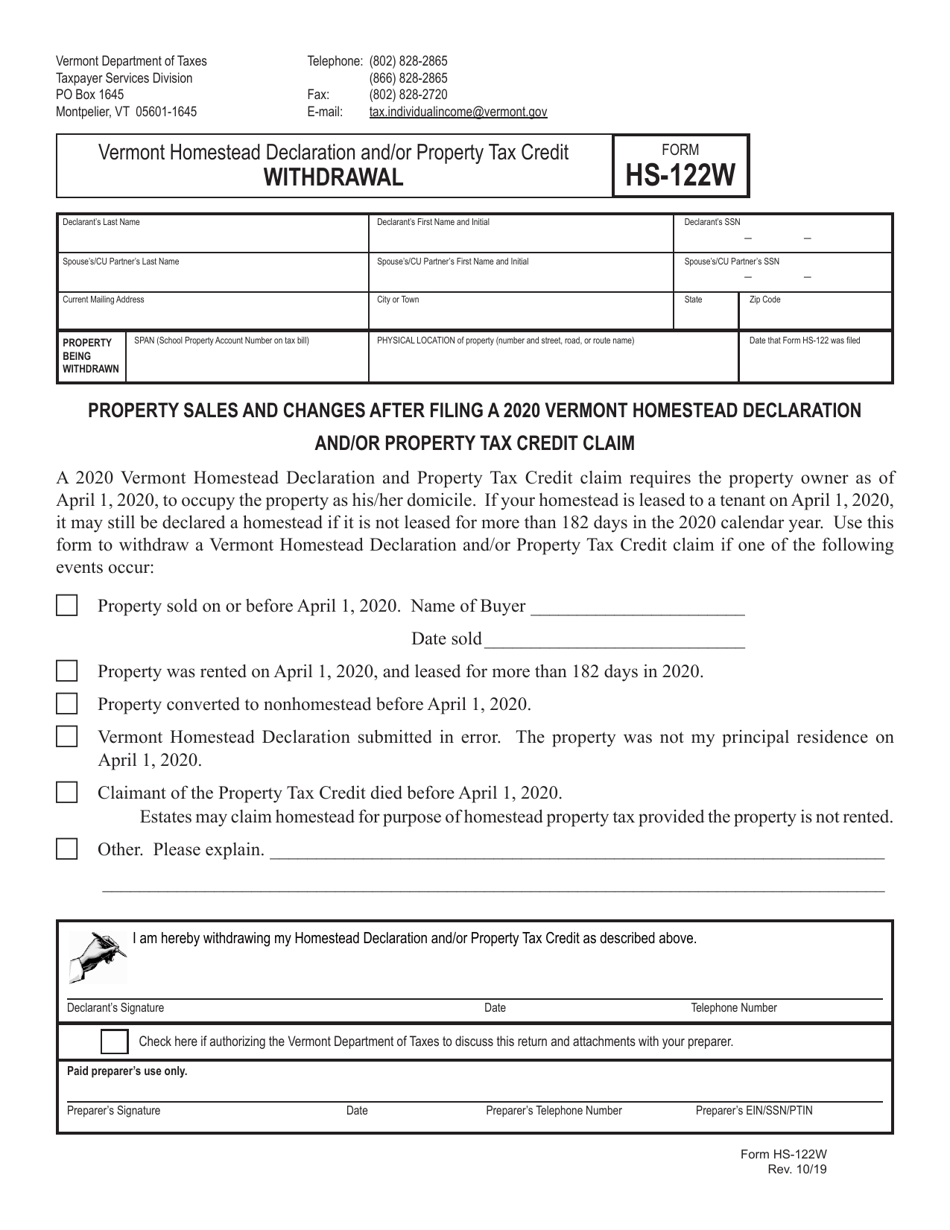

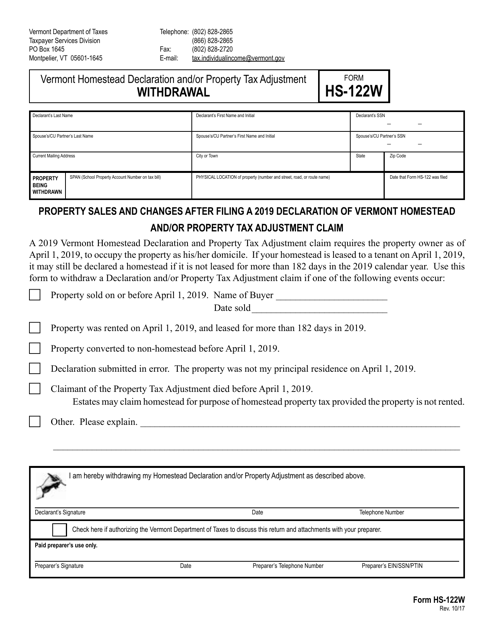

Vt Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Adjustment Withdrawal Vermont Templateroller

Information on upcoming tax filing deadlines and these programs is.

. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Start completing the fillable fields and. Quick steps to complete and e-sign Vt homestead declaration online.

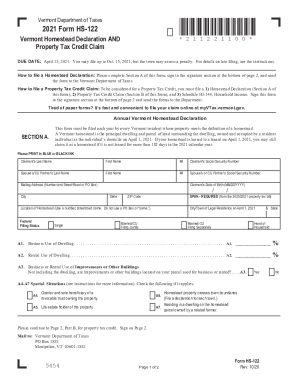

Taxpayers having trouble filing Homestead Declarations and Property Tax Credit Claims may call 802 828-2865 for help. Use Get Form or simply click on the template preview to open it in the editor. We last updated the Homestead Declaration AND Property Tax Adjustment Claim in March 2022 so this is the latest version of Form HS-122 HI-144 fully updated for tax year 2021.

Homestead Declaration and Property Tax Adjustment Filing Vermontgov. Upload Modify or Create Forms. Vermont Homestead Declaration Form HS-122 Section A The Homestead Declaration must be filed annually by every Vermont resident homeowner on their primary.

Try it for Free Now. Fri 05142021 - 642am --. Ad Download Or Email DA 1380 More Fillable Forms Register and Subscribe Now.

PdfFiller allows users to edit sign fill and share all type of documents online. Vermont Business Magazine The Vermont Department of Taxes wants. A reminder to everyone to please file your Homestead Declarations as soon as possible.

The definition of a homestead is as. Ad Register and Subscribe now to work with legal documents online. All groups and messages.

Use myVTax the departments online portal to e-file Form HS-122 Homestead Declaration and. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. If your property fulfills the criteria to be declared a homestead you can file a Vermont homestead declaration and property tax adjustment every year.

802 828-2865 133 State Street Montpelier VT 05633-1401 For. If you do not file by this date then you will receive a penalty. Each person who owns property and lives on that property must declare homestead this year by April 18th.

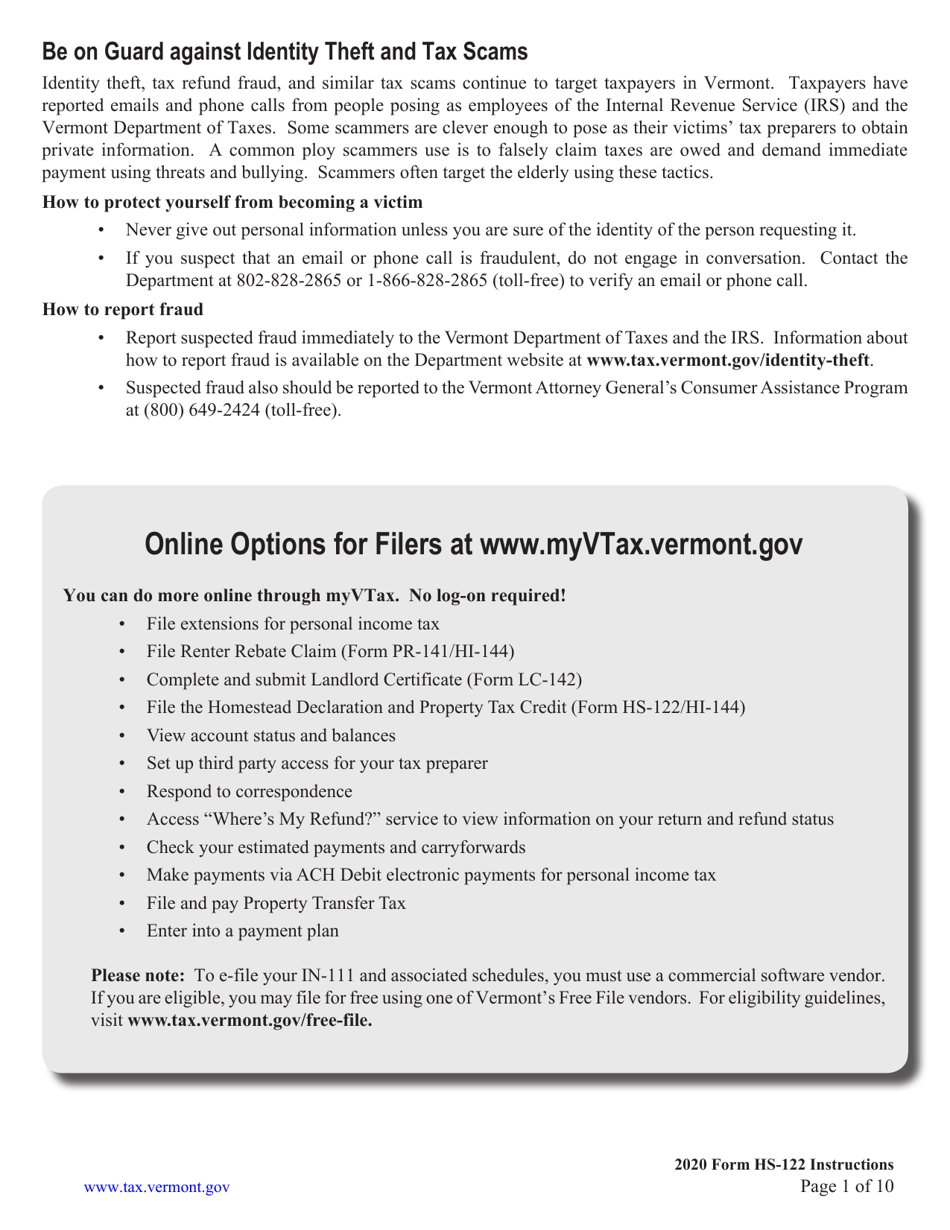

Domicile Statement Property Tax Homestead Declaration Domicile Statement Vermont Department of Taxes Phone. Mon 01242022 - 1200. Tax Year 2021 Instructions HS-122 HI-144 Vermont Homestead Declaration AND Property Tax Credit Claim.

May 17 Vermont personal income tax and Homestead Declaration due date. Property owners whose dwellings meet the definition of a Vermont homestead must file a Homestead Declaration annually by the unextended personal income tax due date April 15. Use e-Signature Secure Your Files.

Vermont tax statutes regulations Vermont Department of Taxes rulings or court decisions supersede information presented here.

Vermont Tax Forms And Instructions For 2021 Form In 111

Vt Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Adjustment Withdrawal Vermont Templateroller

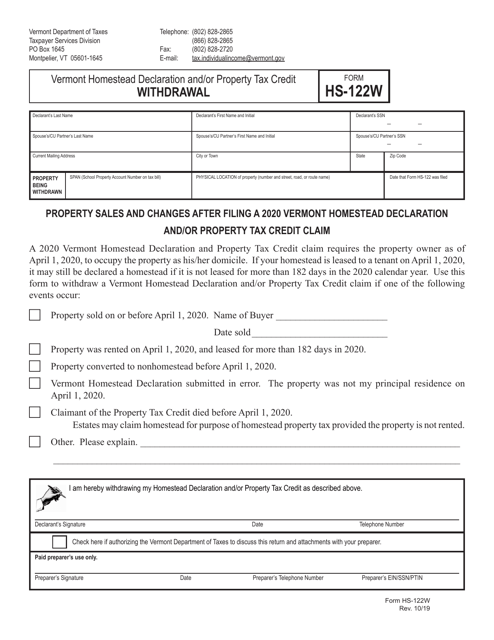

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller

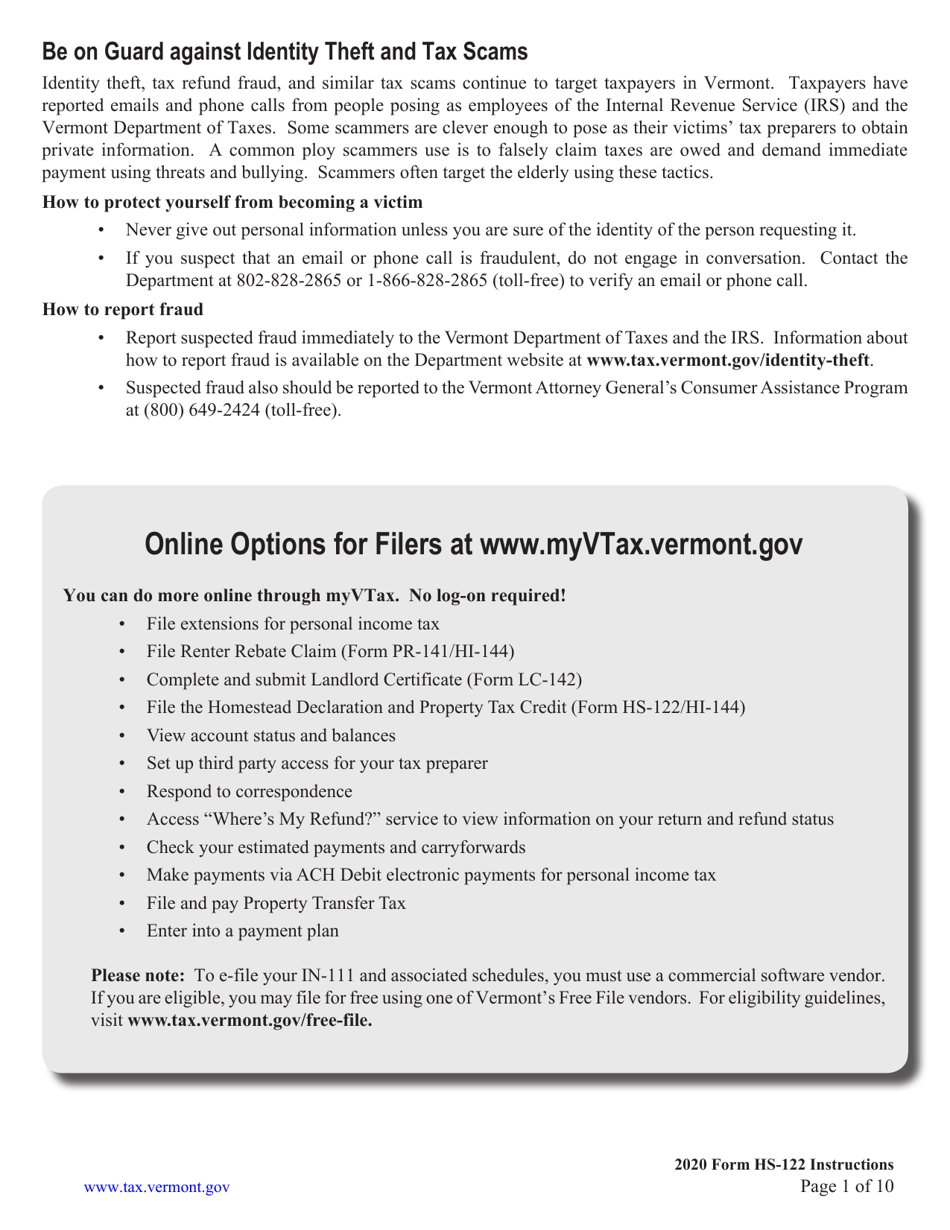

Download Instructions For Form Hs 122 Vermont Homestead Declaration And Property Tax Credit Pdf 2020 Templateroller

Vermont Hi 144 Form Fill Out And Sign Printable Pdf Template Signnow

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller

How To File A Renter Credit Claim In Myvtax Form Rcc 146 V4 Youtube

Vt Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Adjustment Withdrawal Vermont Templateroller

Vermont Department Of Taxes Youtube

Vt Hs 122 Hi 144 2021 2022 Fill Out Tax Template Online Us Legal Forms

Rp 1231 Vermont Department Of Taxes Organizational Chart Department Of Taxes